Growing Your Business With Equipment Leasing

(5 min read)

If you’re looking to grow your business, you might be wondering if now is a good time to invest in new equipment. Well, wonder no more! Equipment leasing is a great way to get the equipment you need for your business without breaking the bank.

In this blog, we break down what exactly equipment leasing is and how it differs from loans or direct purchase, as well as the benefits of leasing equipment when it comes to growing your business.

What is equipment leasing?

A lot of businesses don't have the cash on hand to outright buy new equipment. That's where leasing comes in — it's a form of acquisition that can be an alternative to purchasing or traditional lending. Equipment leasing is based on a rental agreement, offering business owners flexibility and lower risk while getting the equipment required for a job faster.

With an equipment lease, you don’t own the equipment, but rather pay rent for it over a set term. At the end of the term, you can either return the equipment to your dealer or purchase it — but depending on the length of your rental term, that piece of equipment may now be outdated or there’s a newer upgrade available, so continuing with the rental process helps you stay at the top of your game.

An equipment lease covers all costs associated with your new equipment, including shipping, delivery, warranties, accessories, and other necessary costs. By leasing your equipment, you’re able to budget and work with a consistent monthly lease payment over the course of your lease term.

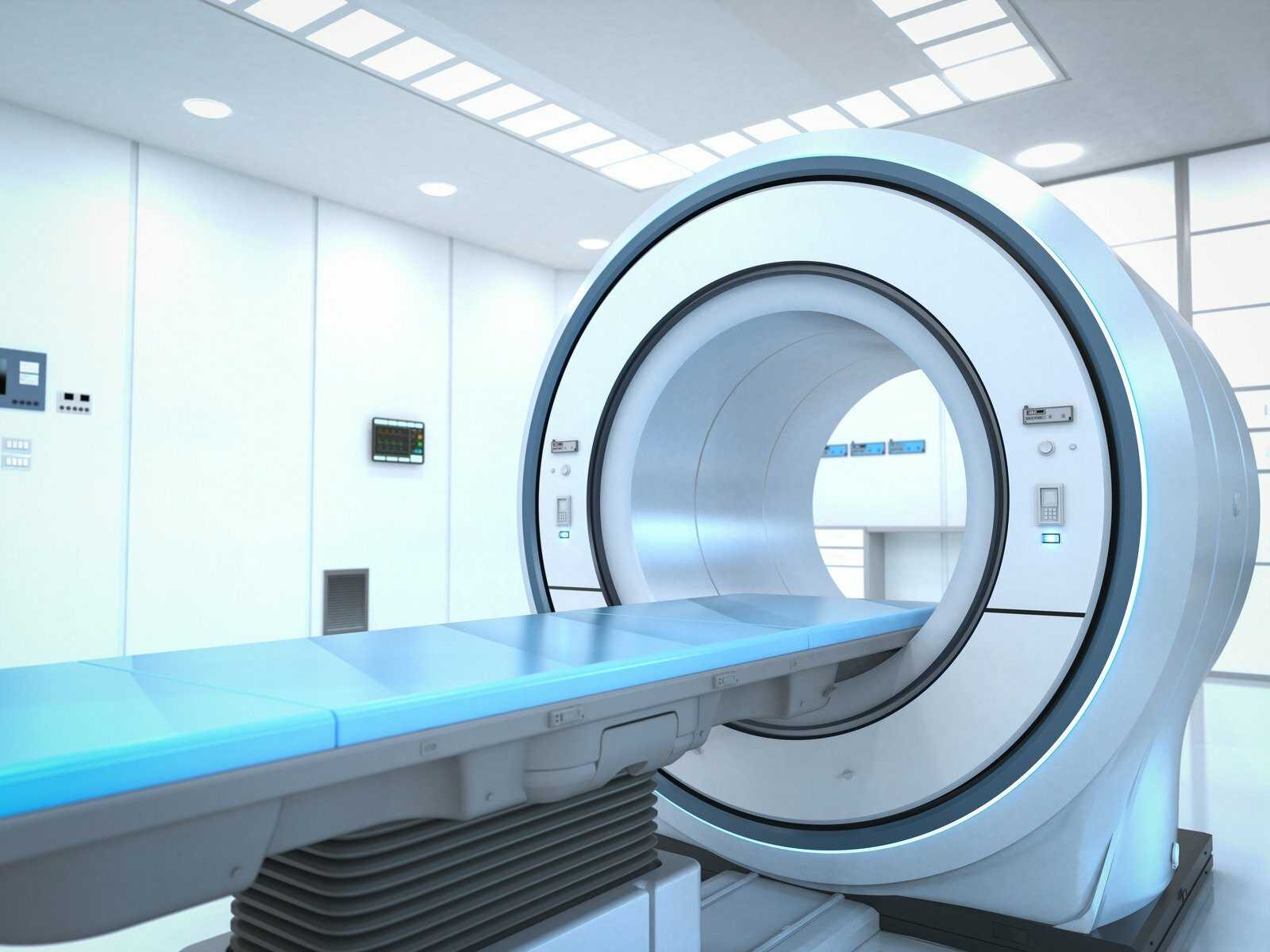

Equipment leasing serves many industries, including trucks and trailers, construction, forestry, hospitality, fitness, health and wellness, and manufacturing. No matter your industry, there are equipment leasing solutions available to help scale your business in the right direction.

Benefits of equipment leasing

With equipment leasing, you're able to get the newest and most up-to-date equipment for your business—without the high upfront costs. This means you'll always be ahead of the competition and able to keep up with changing technology. Renting allows you the flexibility to upgrade equipment as needed — without the expense of a bank loan or purchasing the equipment in full. You won’t have to miss out on an opportunity to grow your business just because you can’t afford the equipment you need — plus, having the best equipment available helps your business be more efficient and gain bigger profits.

If your business requires a $50,000 piece of equipment but you only have $30,000 of available cash or credit, this means you have to settle for less than what’s best for your business growth. By leasing this piece of equipment, you increase your buying power by being able to pay for the equipment you really need. Leasing companies are able to structure the equipment rental agreement on a term that works for your business, with affordable payments that work with your budget.

Leases also help business owners structure their rental terms against the life of the equipment compared to a traditional bank loan. They can be treated as a business expense rather than the equipment depreciation being a cost. An asset such as equipment that depreciates in value can be written off more quickly when it is leased. And since rental leases are fully tax deductible, you’ll be able to save money there too — which means you’ll have more cash available to invest in your business growth.

How to find the right leasing company

When choosing an equipment leasing company, it’s important to research the company’s reputation and experience by reading consumer reviews and comparing lease terms and rates. It’s also important to consult with a financial advisor to make sure what kind of lease terms will work with your monthly cash flow.

Arbutus Capital is a family-owned business that has provided equipment leasing services for over 40 years. Since we own our lease portfolio, credit decisions are made in-house which allows us to give you a quick approval for your equipment lease. We look beyond credit criteria and forms and take a personal approach when getting to know you and your business.

—

Ultimately, leasing equipment can be a great way to help your business grow. You don't have to worry about buying equipment and having it depreciate in value, or buying lower quality equipment that you can afford with the cash you have on hand. Instead, you can lease it and get tax advantages and increased buying power, as well as gaining more flexibility with your cash flow.

Arbutus Capital has a wide range of equipment leasing options for businesses in a variety of industries. We can help you get started with equipment leasing today so you can focus on other important expenses for your business. We want to help your business grow, so contact us today to get started!